Do you need a trust? Well, it depends.

One of the most common questions I hear during our Mutual Interviews is, “Do I need a trust?” And the typical lawyer answer is, “It depends.” In order to answer that question, we need to start by defining what a trust actually is.

I’ve heard it described as a form of divided ownership – where one person owns an asset but only for the benefit of another person – and that’s a pretty good description.

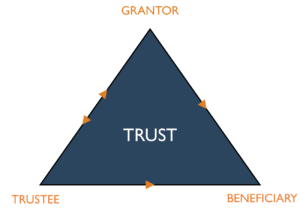

A trust is an agreement between the person who creates it (the grantor) and the person who oversees the trust property (the trustee). This agreement is created all for the benefit of another person (the beneficiary).

As you can see from this diagram, the grantor-trustee relationship is a two-way street while the relationships between the grantor and the beneficiary and between the trustee and the beneficiary only go one way. The two way street is the agreement between grantor and trustee. Both grantor and trustee create the trust with one goal in mind: to provide for the beneficiary. How that is carried out is determined by the terms in the agreement.

The terms are written down in an agreement, normally, and the form of that agreement determines what kind it is: testamentary or inter-vivos/living. But, sometimes a trust is created unintentionally through an oral agreement.

Once you’ve figured out whether a trust is testamentary or living, then you can narrow down the type even further. There are dozens – maybe even hundreds – of types of trusts: special needs, supplemental needs, income-only, spendthrift, asset protection, Medicaid, Veteran, pooled, Miller – the list goes on and on. The type of trust that works best for you – and even whether or not you need one in the first place – will depend on your specific circumstances.

You’re in luck! Trusts are a big part of what we do at Huizenga Law. To learn how one could fit within your estate or nursing home plan, schedule a Mutual Interview with us at (712) 737-3885 today!