The most frequently used tool to protect and care for children with special needs after both parents has passed is a special needs trust, says Forbes in its recent article. This is a legal instrument used to provide benefits to an individual with special needs while also maintaining that person’s ability to receive state or federal benefits. The trust is usually created by a parent or guardian with the special needs child as the beneficiary.

The most frequently used tool to protect and care for children with special needs after both parents has passed is a special needs trust, says Forbes in its recent article. This is a legal instrument used to provide benefits to an individual with special needs while also maintaining that person’s ability to receive state or federal benefits. The trust is usually created by a parent or guardian with the special needs child as the beneficiary.

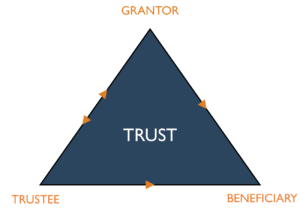

A third-party trustee is often appointed with the authority to make distributions from the assets in the trust on behalf of the beneficiary. This lets parents make sure their child has their needs met after they pass away.

Some government benefits used by a person with special needs—such as Supplemental Security Income (SSI) and Medicaid—are “means tested.” That means they are only available to those who themselves have limited income or assets. If a parent wants to provide support to a child with special needs after the parent’s death, those assets must pass correctly to ensure that the assets don’t cause that child to directly own the assets and thereby lose their government eligibility for the benefits.

Again, any assets left directly to the beneficiary without use of a trust could disrupt the beneficiary’s receipt of benefits, taking money and support away from the beneficiary.

- The most common special needs trust is a third-party special needs trust. This is funded by family members to ensure that there are specific assets set aside for the beneficiary’s utility bills, education, entertainment, or most other regular expenses.

- There are also first-party trusts, which is established with the assets owned directly by the child with special needs. This can result when the child with special needs receives an inheritance, life insurance payout, or personal injury settlement directly, which may impact their existing benefits.

- There are also pooled trusts, which are managed by a nonprofit organization. With a pooled trust, the grantor doesn’t have to name a trustee, especially one who may not have experience in managing trust assets. Consequently, the assets are held for the benefit of the child with special needs, but they are managed by an organization with expertise in doing just that.

- An ABLE account is another option. They’re not trusts, but they allow up to $15,000 a year to be earmarked for the benefit of a person with special needs. The distribution rules are similar to those of a special needs trust.

There is significant complexity with the laws surrounding special needs trusts, so you should work with an experienced estate planning attorney or elder law attorney.

Reference: Forbes (Sep. 10, 2020) “Making Trusts for Special Needs Children”