How Do Estate Plans and Trusts Work?

In this article, we will address two terms which some people use interchangeably, but which are very different things: living trusts and estate plans.

In this article, we will address two terms which some people use interchangeably, but which are very different things: living trusts and estate plans.

Leaving behind a huge tax bill for your heirs with the stretch IRA scuttled? Here are some ways around it as lawmakers consider an updated SECURE Act.

The ‘HEMS’ (health, education, maintenance, support) standard in estate planning is used to guide trustees in how/when they should release funds to a beneficiary.

Life estates can provide effective means to create joint ownership of property, avoid probate and transfer property after death without incurring gift taxes.

Both help you pass down assets, while avoiding the time and expense of probate. However, one has much more flexibility than the other.

On the surface, the difference between revocable and irrevocable trusts couldn’t be any more straightforward. You can change your revocable trust whenever and however you choose. You can’t change your irrevocable trust at all.

What are the advantages of putting assets into a trust?

Have you made any plans to distribute your assets and take care of your family, when you die or become incapacitated?

Done right by a lawyer, your heirs can avoid the expense and time of probating your will and may save on estate taxes, while easing the administration of your affairs while alive and after you have gone.

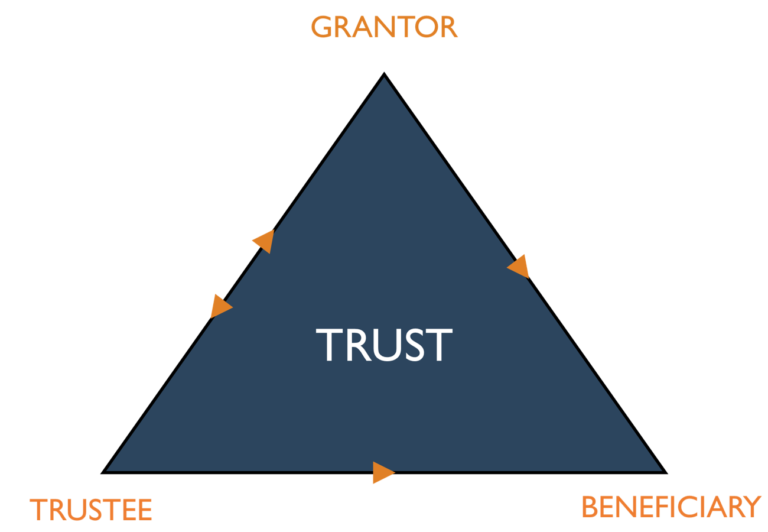

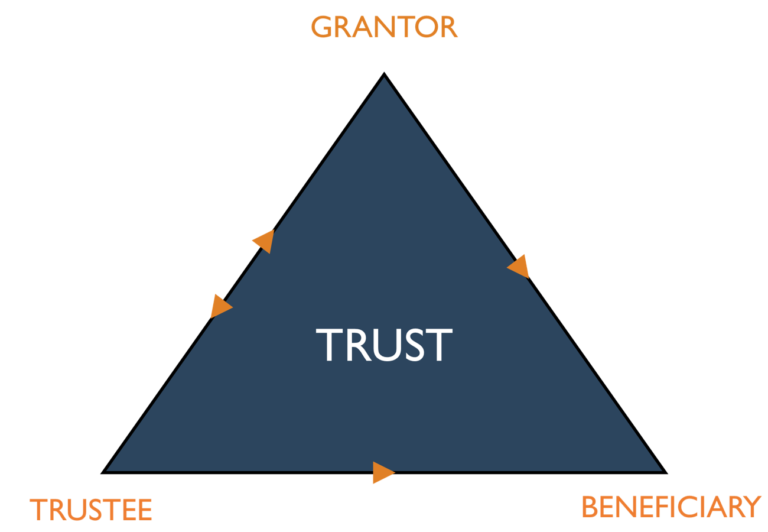

A trustee is a manager of assets in a trust. The grantor creates the trust and appoints the trustee. A trustee has a ‘fiduciary duty’ to serve the grantor and not benefit personally.