4 Social Security Steps after Someone Dies

When a loved one passes away, there are usually various arrangements that need to be made. One of the tasks to oversee will involve reporting the death to the Social Security Administration.

When a loved one passes away, there are usually various arrangements that need to be made. One of the tasks to oversee will involve reporting the death to the Social Security Administration.

The loss of a family member or friend, sad as it may be, is hardly unusual. How do you put it into words? What do you say when someone dies?

Taking out a funeral plan does not only have cost benefits but can also ease some of the emotional distress at an already difficult time.

Thinking about buying a burial plot can be uncomfortable. However, making this purchase ahead of time has its advantages, including potentially saving you money.

The list of things you need to do after someone dies can seem endless, especially during a time when you are also grieving.

If you have updated your estate plan during the Covid crisis and even found a way to sign your documents while maintaining social distance, do not overlook the last step of trust funding.

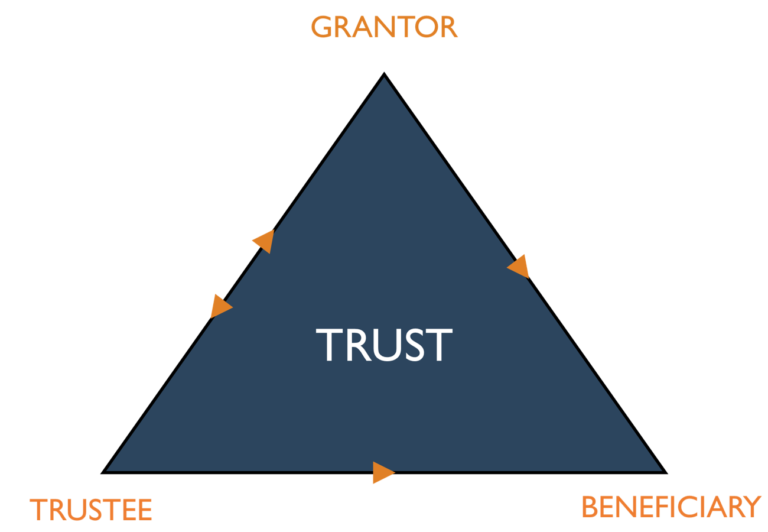

Trusts are legal entities that own assets, and all trusts are not alike. They are created by a written trust document with certain provisions that can vary from trust to trust.

It’s never too early to start working on how your things will be handled, once you pass away.

The death care industry — yep, it’s got its own industry moniker — is an estimated $20 billion business. Service Corporation International, a publicly traded company that operates 1,475 funeral homes and 483 cemeteries in 44 states, pulled in more than $3.2 billion in revenue in the past 12 months.

There might be a time in your life when someone you know pulls you aside at a family gathering and says that you’re the designated beneficiary of their life insurance policy.