Planning for Nursing Home Expenses

A revocable trust is great for many reasons, but it does NOT protect assets from nursing home expenses.

A revocable trust is great for many reasons, but it does NOT protect assets from nursing home expenses.

We may think of a spoiled heiress to a large fortune, whose parents were savvy enough to prevent her from having full access to her funds. On the other hand, we could imagine a loved one with special needs, whose needs will be provided for with trust-protected money.

It is also important to realize that it isn’t merely “why” you are updating your will, but “when” you are updating that can make all the difference. Acting too late (or too early) may mean your changes are no longer appropriate or even immediately invalidated.

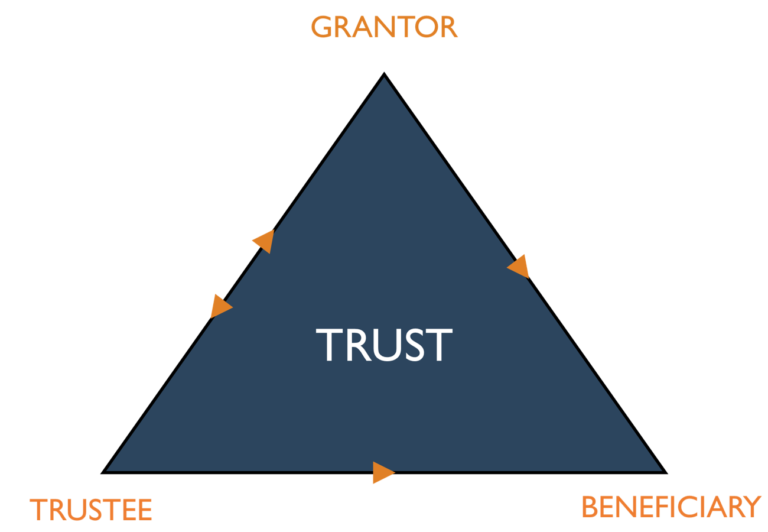

Trusts are legal entities that own assets, and all trusts are not alike. They are created by a written trust document with certain provisions that can vary from trust to trust.

For example, did you name someone as an heir who is no longer in favor with you or—worse yet—has died? Who should get what they would have gotten? Are there now new people in your life—be they family members or not—whom you might wish to share in what you may have?

One problem that frequently stems from the inheritance process is fractured relationships between siblings. Unfortunately, the common denominator in many of these situations is the parents’ estate plan.

Whenever you open a financial account, you’re almost always asked to name a beneficiary. Simply stated, a beneficiary of the account is someone who is entitled to the benefits of the account, typically, on the death of the account holder. If you’ve purchased life insurance, for example, you name a beneficiary, who receives the benefits of the policy when you pass.

Whenever you open a financial account, you’re almost always asked to name a beneficiary. Simply stated, a beneficiary of the account is someone who is entitled to the benefits of the account, typically, on the death of the account holder. If you’ve purchased life insurance, for example, you name a beneficiary who receives the benefits of the policy when you pass.

Beneficiaries of a trust typically pay taxes on the distributions they receive from the trust’s income, rather than the trust itself paying the tax. However, these beneficiaries are not subject to taxes on distributions from the trust’s principal.

There might be a time in your life when someone you know pulls you aside at a family gathering and says that you’re the designated beneficiary of their life insurance policy.